AI Tools for Voice of the Customer in Banking – Two Use Cases

Voice of the customer (VoC) is a term used in modern business practices to describe customers’ feedback about their experience with the products and services both inside and outside any official business channels to make their opinions known. Businesses capture the voice of the customer data to provide the best possible customer experiences. The process needs to be proactive and innovative to capture the customers’ changing requirements with time.

Online reviews and feedback have proven to be a reliable source and channel for understanding customer needs for the product or service. It also helps to analyze product competitiveness in the marketplace.

Traditional and classical methodologies in capturing the voice of customers have focused mainly on market surveys and questionnaires. But listening to customers is only beneficial if the feedback data is analyzed and efforts are made to make the course corrections.

This article will explore two of the most prevalent real-world applications of AI to capture the voice of the customer in banking by exploring two use cases:

- Personalizing customer conversations: Using NLP in conjunction with conversational AI to make conversations with customers over chat more engaging and relevant to their interests.

- Analyzing customer sentiments: Using deeper data insights to draw the exact sentiment and attitudes from customer feedback.

For each use case, we further discuss the business challenge said technology solves, the data being leveraged in the process, and the distinct benefit that AI applies to the processes therein.

Use Case #1: Conversation AI Using NLP

Conversational AI helps humans to communicate with an automatic system using natural language. The interaction could be text or speech-based. Conversation systems, depending on their capabilities, domain, and level of intelligence, are known as chatbots, conversation agents, virtual assistants, or bots.

Conversational agents such as chatbots have been around for a long time. However, these models’ practical utilization and effectiveness have only increased due to machine learning and NLP advances.

Many advanced chatbots leverage NLP capabilities. Computers are configured to read, process, and analyze large amounts of natural language information. AI bots learn from people’s conversations and interactions to expand their database. Unlike AI-based chatbots, rule-based chatbots no longer respond when they encounter unfamiliar commands and unrecognized phrases.

Another challenge with rule-based chatbots is that they are typically guided by a decision tree, resulting in interactions with the chatbot that feel robotic and not conversational. The customer or the user can be given a set of predefined options that lead to the desired answers. However, doing so often limits their feedback and adversely affects the customer experience.

Rule-based chatbots only answer questions within the predefined limitations, and often they cannot learn independently, requiring businesses to train and improve them manually.

AI-based chatbots offer various services to the company, including automatic customer service. Applying speech recognition and NLP, AI-based chatbots can address even the complex request from the user.

Vendor Example: Active.Ai

Active.Ai is a Singapore-based fintech startup with subsidiaries in the US and India. The company uses AI to deliver conversational banking services. The website mentions that it uses advanced NLP and machine intelligence to enable customers to have natural conversations over messaging, voice, or IoT devices.

Triniti API offers cutting-edge capabilities to financial institutions to provide their customers with a natural channel of engagement via voice and text. The company claims that Triniti’s state-of-the-art AI algorithms enable it to identify and understand intent, interpret discourse and reactions, extract entities and recognize values, and analyze sentiments and emotions in conversations.

The company’s website also claims they have tuned their AI engine specifically for banking and finance. Their technology is built with a preprocessor, NLP, NLU, NLG, and machine comprehension in mind.

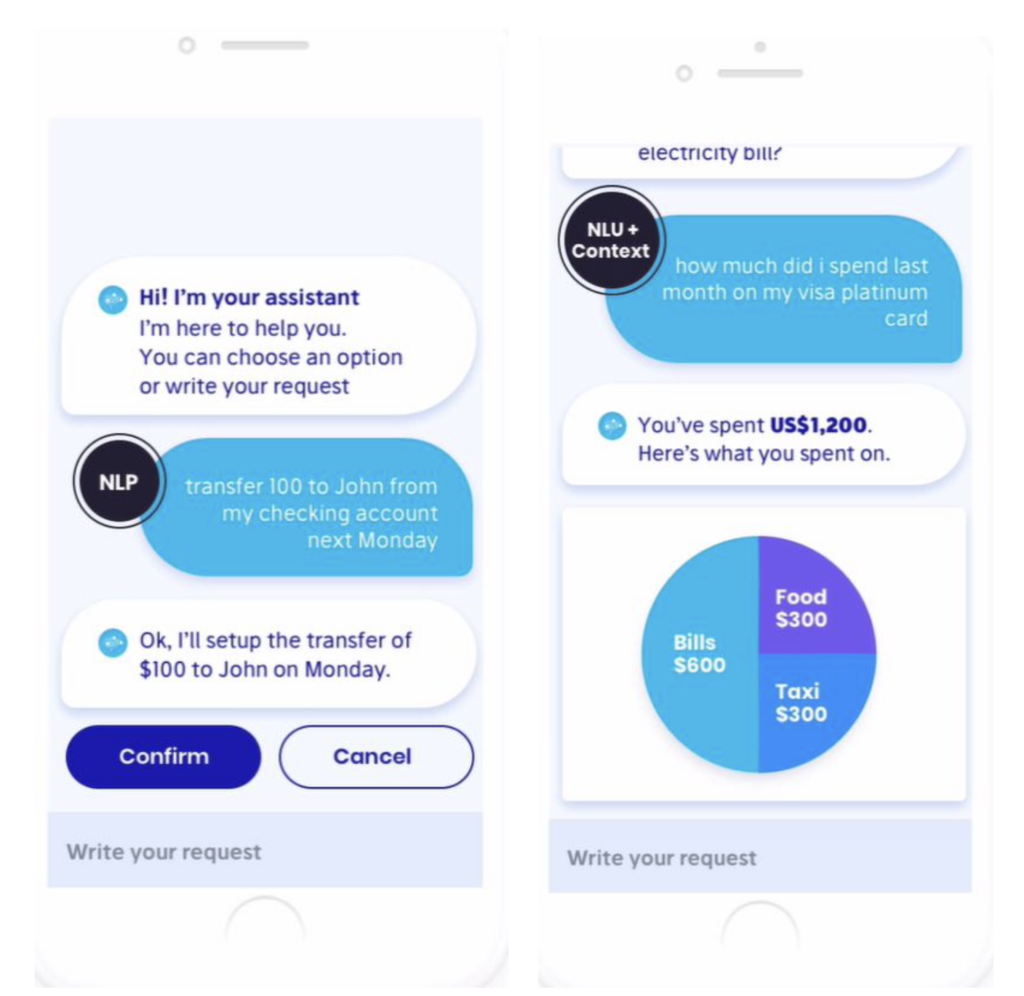

Screenshots from customers’ conversations with the chatbot (Source: Active.Ai)

Axis Bank, an Indian banking and financial services company, wanted to deliver easy interactive conversations to its customers through its mobile application. The bank wanted to provide an experience that did not feel robotic and was more than just a rule-based chatbot. In partnership with Active.Ai, the bank launched Axis Aha!, a conversation AI platform.

The conversation platform can process transactions, service requests, and inquiries and help customers to apply for credit cards and loans.

Screenshot from Axis Bank case report (Source: Active.Ai)

The Active.Ai case study report claims that the NLP-based chatbot helped the bank to process 20 million plus utterances with 97 percent data accuracy. It further mentions that the conversational platform has a 40x growth rate by a factor of 40.

In one of the interviews with Express Computers, Praveen Bhatt, Head – of Digital Banking & Customer Experience at Axis Bank, revealed that the initial idea was to convert chatbots into personal relationship managers. The bank was aggressively focusing on personalization to stay relevant to the customer rather than targeting them through just emails that are generic in nature.

The same interview mentions that previously the bank had 300 email agents, which had gone down to 70 agents after implementing Active.Ai’s solution. The solution was better able to evaluate the customer experience, which resulted in a drop in email volumes since enough necessary customer inquiries were moved to the chatbots.

Use Case #2: Analyzing Sentiments from Customer’s Feedback

Sentiment analysis involves techniques, tools, and methods to detect and extract subjective information from languages, such as opinions and attitudes. It helps find the customer’s mood about what he said or wrote.

Also known as opinion mining, sentiment analysis is the study of sentiments that determines the judgment of people’s opinions, evaluations, and emotions concerning entities such as products, services, and emotions.

To help understand language difficulties such as sarcasm, ambiguity, context, and irony, the manual processing of sentiments needs a human component in the analysis. While sentiment analysis can be done manually by humans, the challenge becomes the accurate meaning of the opinion and detecting whether unsuitable sentiment is positive or negative.

Though the manual process helps improve the analysis’s accuracy, it is time-consuming.

AI-based approaches to sentiment analytics denote natural language processing, text analysis, linguistics and biometrics to methodically identify extract, quantity, and the study of expressive states and individual data.

These sentiment analysis systems use natural language Processing (NLP) and machine learning to quantify sentiments by looking for topics, themes, and categories within sentences as a positive number, negative, or zero.

Vendor Example: Keatext

Keatext is a Montreal-based software development company. It provides text and sentiment analysis platforms for a 360-degree view of customer feedback.

Keatext Review Analysis offers sentiment analysis for reviews and feedback from the customer. Its advanced AI goes beyond basic analysis by providing suggestions, multilingual analysis, and automatic grouping. The company claims that the platform unifies insights from customer conversations in multiple languages. It can process data from 50 plus languages to English without missing out on the sentiments.

The company’s website also claims that this platform helps businesses to:

- Monitor overall brand perception

- Know the root causes of negative reviews

Using data from sources like NPS or CSAT surveys (sources where a rating scale is paired with an open-ended response), Keatext identifies up to 12 topics and ranks the impact of those topics on the associates’ scores.

1. For an analyst or marketing manager, the recommendation module of the platform offers a listicle view of the strengths and weaknesses in the feedback data.

Screenshot from Keatext Demo Video. (Source: Keatext)

2. The SWOT chart (Strengths, Weaknesses, Opportunities, and Threats) provides details into what impacts customer satisfaction so the business can prioritize what needs attention.

Screenshot from Keatext Demo Video. (Source: Keatext)

3. To get a detailed view of why a particular business factor has a negative value, the analyst can get the view of opinions in the list, which displays certain words from customers’ feedback like high, shocking, or outrageous.

Screenshot from Keatext Demo Video. (Source: Keatext)

4.The dashboard provides a heat map of the comments and feedback. For instance, in the picture below, there is a correlation between outrageous and fee with 200 comments.

Screenshot from Keatext Demo Video. (Source: Keatext)

5. The comment overview section divides all the feedback into four main categories:

- Praises

- Problems

- Suggestions

- Questions

This feature can help the team to go deep into the pain points and prioritize the efforts.

Screenshot from Keatext Demo Video. (Source: Keatext)

6. The dashboard also provides a sentiment score based on the analysis. This score can be viewed separately for praises, problems, suggestions, and questions or all together for the brand name.

Screenshot from Keatext Demo Video. (Source: Keatext)

While Keatext does not provide public information citing measured, tangible business results for the banking sector, their case study reporting claims that time to insights was reduced by 98% for one of their clients.

It further mentions that it previously used to take the client 8 hours to parse the details of the data in 6,000 reviews, but now it takes just 10 minutes using Keatext.