Artificial Intelligence at Goldman Sachs

Goldman Sachs was founded in 1869 and joined the New York Stock Exchange in 1896. Since 2016, Goldman Sachs has begun moving into consumer financial products. The company is headquartered in Lower Manhattan with regional offices in England, Poland, Hong Kong, Tokyo, Bangalore, and on US soil in Dallas and Salt Lake City.

As of March 2023, Goldman Sachs trades on the NYSE with a market cap of $119 billion. As recently as 2020, the number of employees at Goldman Sachs reached 40,000. Their highly-trained lawyers are the most relevant employees to the use cases discussed below.

In this article, we will examine two use cases that demonstrate how Goldman Sachs is currently using AI, including natural language processing, in both their contract lifecycle management process and in meeting regulatory compliance requirements that have heightened in recent years:

- Intelligent document automation: Goldman Sachs improves how they create documents in their contractual processes with RPA and natural language processing.

- Contract analysis: To better meet requirements mandated by the Dodd-Frank Act, Goldman Sachs uses natural language processing to analyze qualified financial contracts efficiently.

First, we will cover how Goldman Sachs uses AI to solve specific challenges that document creation presents.

Using Intelligent Document Automation

As one of the world’s largest investment and financial services companies, Goldman Sachs processes millions of contractual documents for their many business relationships per quarter. Financial services companies often have SharePoint repositories that contain as many as several hundred variations of the same document, with just slight differences in content.

It then becomes time-consuming and cumbersome to sift through so many documents.

Typically, after searching through the existing unstructured documents, they need to make some edits for a specific deal they’re working on. Doing so adds another unstructured document to the library each time.

Arteria AI spun out of Deloitte in 2020. At the time, Shelby Austin was head of Omnia, Deloitte’s AI business in Canada. Austin recognized the drawbacks associated with the traditional process of creating contracts. Her approach is focused on changing the process of creating documents by creating structured data from the start.

Arteria offers an enterprise SaaS platform for digital contracting. Their platform provides a solution to ineffective manual processes and works in the following way:

- Takes unstructured documents

- Parse the documents

- Extracts key contractual elements into structured data

The ultimate goal in improving and optimizing the document creation process is to improve the employee experience. In a 2022 annual report for the fiscal year ending December 31, 2022, Goldman Sachs recognizes the competition they face in both attracting and attaining qualified employees.

In addition to improving the document creation workflow, Arteria also claims their solution uses machine learning to enhance the contract negotiation process. Machine learning can help to identify patterns and insights that can be used in the negotiation process.

An acclaimed lawyer, Tuvia Borok is also a Managing Director at Goldman Sachs. In an interview with Forbes, Borok mentioned that there is an element of cultural change that is inherent in advanced technological solutions. Legal professionals are concerned about how automation will impact their jobs.

The implemented solution speeds up the slow manual contract creation and negotiation process. Bork was still careful to point out that Goldman is trying to make the job of contract negotiators easier, not replace them.

Efficiently Analyze Qualified Financial Contracts Using Automation

Since 2015, the US Treasury has placed various mandates related to transparency on American financial institutions as part of the Dodd-Frank Act.

Per changes enacted by the law, not only are financial firms required to maintain detailed records about their qualified financial contracts (QFCs), but also they have to provide any information a primary financial regulatory agency requests within 24 hours.

Goldman Sachs is on the list of globally systemically important banks (or G-SIBs). They had the following components as part of their previous workflow:

- Upstream document repositories that included 50+ agreement types as part of their QFC portfolio and several hundred thousand documents

- Downstream data lakes and systems

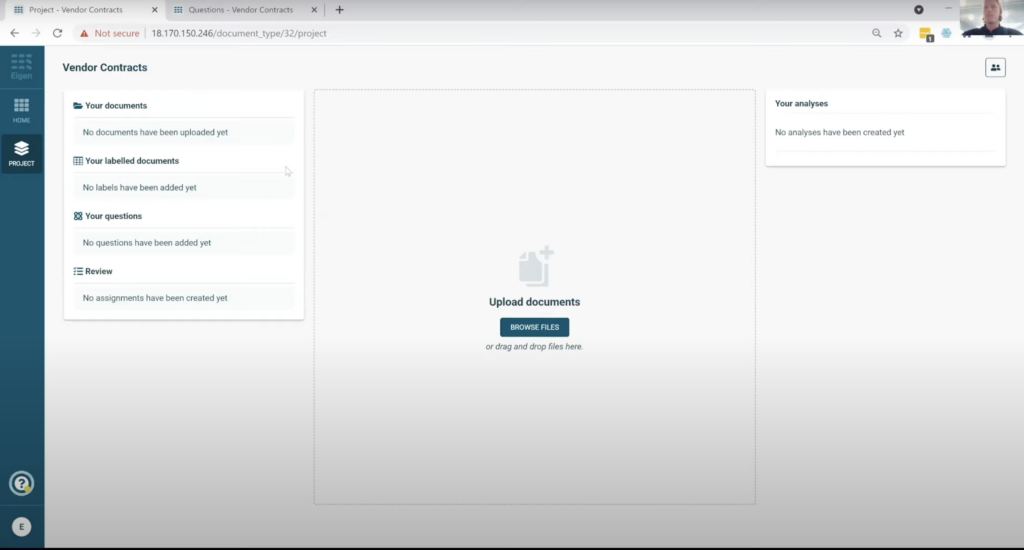

By using Eigen’s platform, Goldman Sachs has been able to automate document processing needed as part of meeting compliance regarding QFC and derive meaning from unstructured data in their myriad of documents.

Donna Mansfield, a Managing Director in the Legal Division at Goldman Sachs, had the following requirements for their needed solution:

- Analyze the 50+ agreement types in their QFC portfolio

- Compile relevant information from several hundred thousand documents

- Extract information from QFCs for additional due diligence or reporting purposes, including but not limited to, SR 14-1 and BRRD

- Automatic upload of extracted information to data lakes

Eigen claims their solution helped Goldman Sachs meet current regulatory compliance and enabled them to extract additional data points to meet the other compliance measures, including:

- Brexit

- BRRD adherence

- LIBOR transition

- US stay rule compliance

While Goldman Sachs has not published specific tangible savings related to time or money, EigenTechnologies broadly claims their customers typically achieve multiple benefits, including:

- An 80% productivity boost in ongoing legal documents and contracts review

- A 67% time reduction in analyzing complex documents