BSA Compliance with AI – Three Use Cases

Among financial cybercrime, money laundering is among the top concerns of global authorities today. In a poll for INTERPOL’s inaugural Global Crime Trend report released earlier this year, 67 percent of nations ranked money laundering as their number one crime threat.

Money laundering itself is a crime as old as time. Still, the modern era of money laundering detection for financial institutions arguably began in the 1970s, when U.S. Congress passed the BSA (Banking Secrecy Act).

The law mandates that financial institutions must keep a record of the people who have a high “degree of usefulness in criminal, tax, and regulatory matters.” according to an IRS synopsis of the text. The intention behind the law was to combat money laundering and the financing of terrorism. The BSA also provides a base to promote financial transparency and detect those who misuse the financial system to move funds for illicit purposes.

The BSA also represents the basis for a wide range of international standards for banks and financial institutions to detect and report money laundering and know who their customers are.

The rigidity of the standards within the BSA provides a rules-based system across jurisdictions worldwide that offers fertile ground for the successful application of AI, as evidenced by a healthy vendor market for AML- and KYC-focused solutions.

This article will explore three of the most prevalent real-world use cases of BSA compliance with AI. For each use case, we further discuss the business challenge said technology solves, the data being leveraged in the process, and the distinct benefits and results that AI brings to the processes after that. The use cases we will explore include the following:

- Streamlining customer identity verification: Reducing errors and time spent digitally verifying customers’ identities.

- Detecting fraud and money laundering incidents: Training models to create alerts for fraudulent transactions automatically.

- Eliminating false positives: Reducing false positive alerts in detecting BSA-related compliance breaches.

We will begin with identity verification, which has become the foundation of eliminating fraud.

Use Case # 1: Autonomizing Identity Verification

As per the Banking Secrecy Act, all banks and financial institutions have to check the identity of anyone who opens an account or buys any financial product/service with them. It is one of the procedures financial institutions must undertake under the BSA’s standing money laundering rules to stop criminals from using them to launder money.

Knowing who the customer is and verifying their identity is the heart of both KYC (Know your customer) and AML (Anti-money laundering). It prevents banks and financial institutions from being used for money laundering and fraudulent activities.

The core challenge in BSA compliance is the large number of transactions and customers that banks onboard today. Given the challenges banks and financial institutions can face while carrying out transactions globally, KYC can take on equally global proportions in terms of potential consequences.

Hence, emerging technologies like AI can help companies with greater precision and speed in analyzing large amounts of structured and unstructured data.

With its new application, Card+, DBS bank wanted to empower customers to access banking through a single app. According to a case study report from Onfido, an AI vendor specializing in identity verification, the challenge was onboarding customers on the new application seamlessly while abiding by KYC and AML standards. Failing to do the proper checks would put DBS at regulatory and fraud risk.

The case study report goes on to claim:

- The bank partnered with Onfido to get seamless UX and robust fraud accuracy to solve this challenge.

- The AI-driven identity verification software runs on the customer side when they sign up for an application.

- The Onfido platform also integrates with CRM software like Salesforce, allowing the bank to request KYC information from any customer.

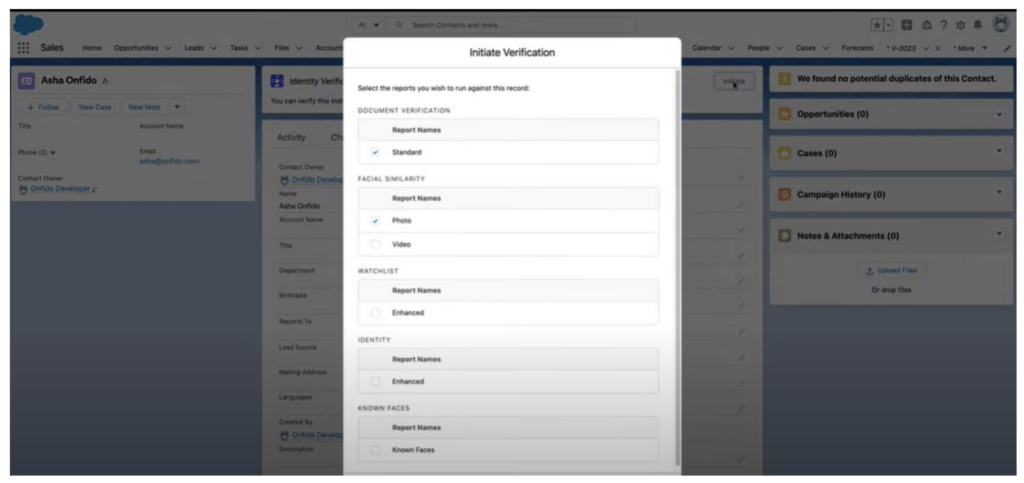

According to an Onfido demonstration video, the workflow for a user to request KYC information from a customer consists of the following:

1. The user has to click on the initiate tab to begin the process and input the customer’s email address in the field:

2. The user then selects the type of verification needed and picks the appropriate boxes:

3. On choosing to move ahead, the software will initiate the verification process and generate a link for the customer, which is sent to them via email.

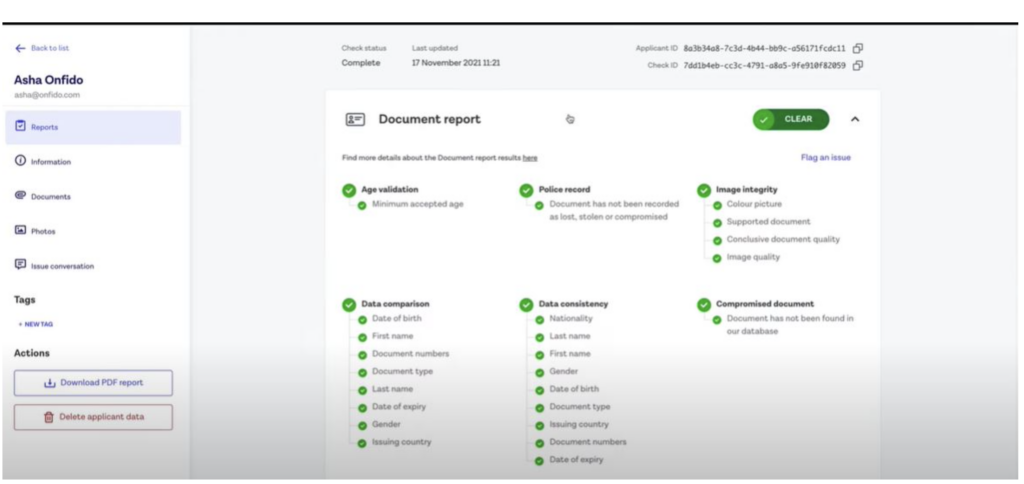

4. Once the user updates his information and identification on the link sent to him, the dashboard on Onfido changes its status. It displays clear status if the identity is legitimate and verified.

5. Further, on clicking the detailed report, the user is taken to the document report with the detailed checklist:

With the new solution in place, the Onfido case report claims the following business results for the bank:

- 96% of customers verified within five minutes.

- 98% of customers were automatically approved, with BDS bank receiving a clear response.

Use Case # 2: Detecting Fraud and Money Laundering Incidents

The BSA also requires financial institutions to establish anti-money laundering (AML) programs. While the companies are asked to have a designated compliance officer and educate employees on the program, it also needs the banks to:

- Develop risk-based AML programs

- Establish an effective process to monitor and report illicit financial activity

Per an update to the law on April 1, 2013, financial institutions must use the BSA E-Filing System to submit the Suspicious Activity Report (SARs).

The creation of SARs, analyzing thousands of data points to monitor the transactions in near real-time to detect fraud, is what AI does best.

According to a case study report from AML software provider C3 AI, an anonymous large multinational bank faced challenges in detecting and monitoring financial activities. The bank was operating AML compliance to identify and detect money laundering activities across its 15 million global customers.

The bank faced significant challenges in the process with the efficiency and effectiveness of the programs. With the software that the bank used, it was facing the challenge of:

- Low case-investigation quality

- High false positive alerts

- Missing high-risk money laundering activities

In addition, the data needed to detect fraud was siloed into several different systems across the enterprise, making the investigation process highly manual.

To solve this business challenge, the case report claims the bank adopted AML software from C3 AI to increase the quality of alters and case investigations.

In 12 weeks from kick-off to production-ready application, C3 AI claims their AML application analyzed two years of historical data from 11 data sources and used Natural Language Processing (NLP) to detect suspicious activity.

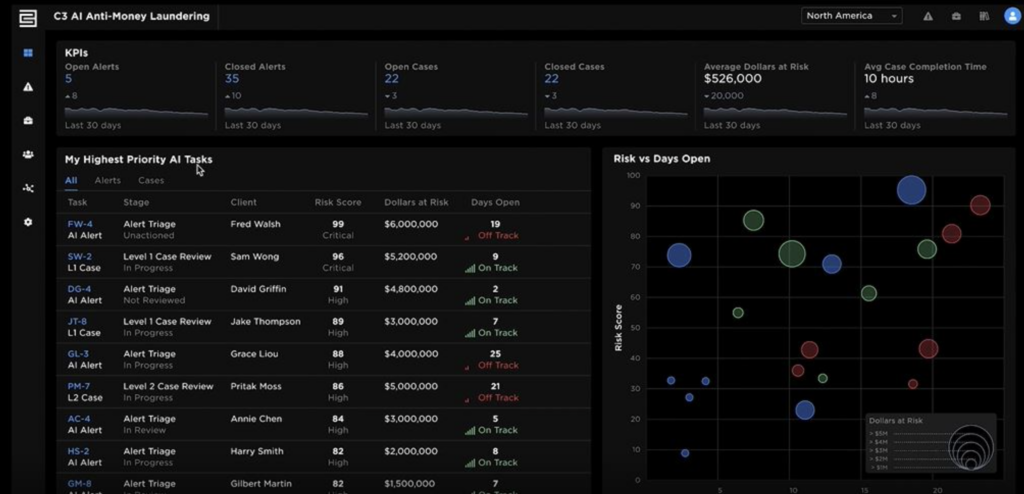

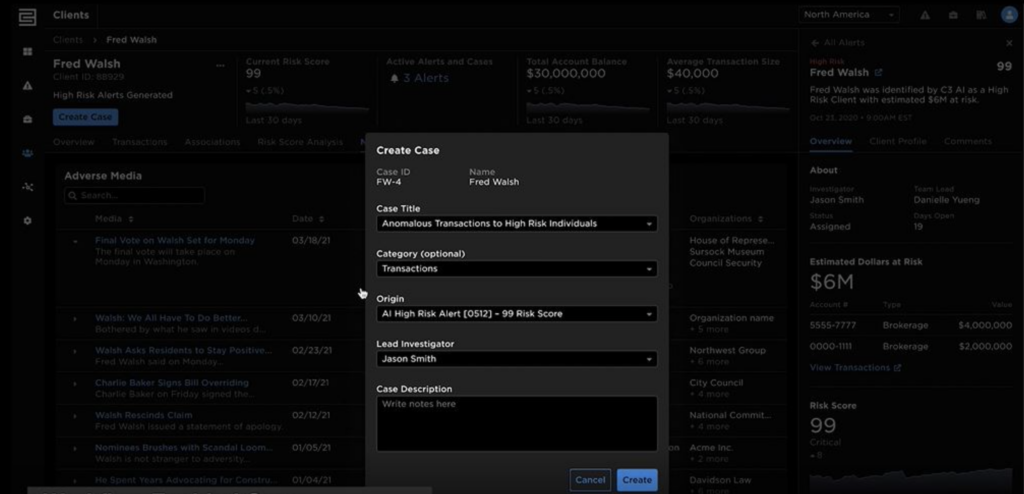

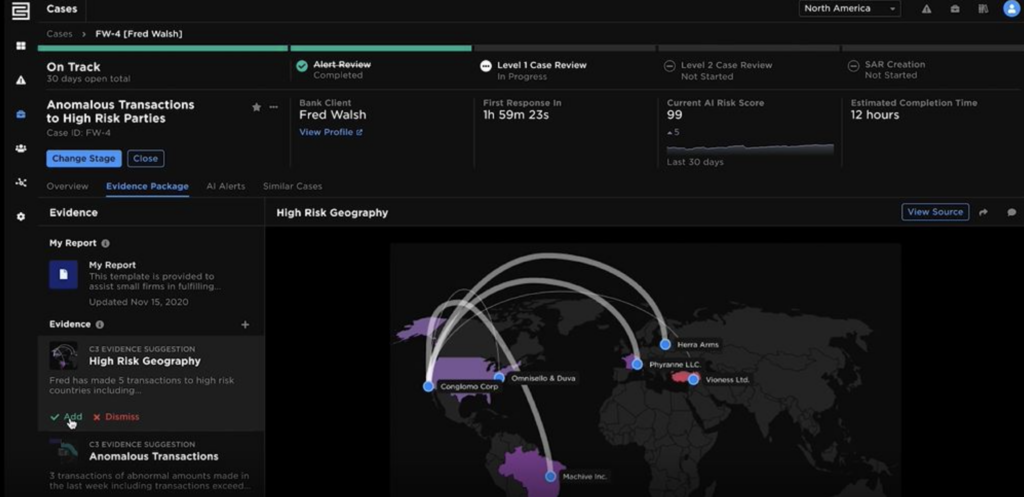

According to a demonstration video for the C3 AML application, the solution’s user workflow consists of the following:

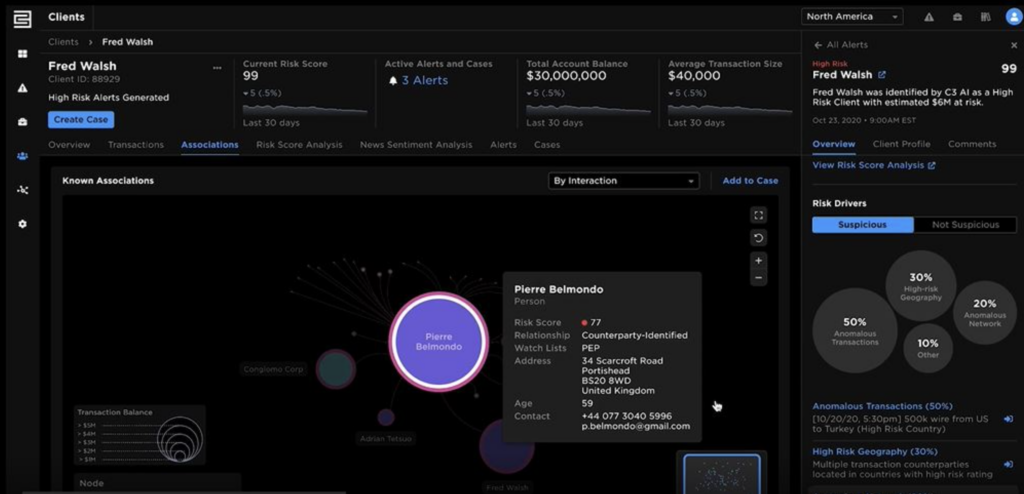

1. The dashboard highlights emerging risks and reveals high-risk clients. The analyst can also see the risk score assigned to each client.

2. In clicking the specific client’s profile, the user can see the in-detail view of the risk drivers. The user can also view the network graphs to determine the relationship between the transaction and party associations.

3. On discovering a high-risk client, the user can open a case- to do a thorough investigation.

4. Once the case is open, the user can see all the strange transactions related to the client to uncover granular insights.

Below is the full 3-minute video that demonstrates the application’s analysis tools, automated model evidence packages, and advanced visualizations of critical contextual case data:

Using C3 AI Anti-Money Laundering application, the case study report claims the bank was able to increase team efficiency along with the following business results:

- 200% increase in suspicious activity cases identified

- 85% reduction in false positive alerts

Use Case # 3: Eliminating False Positives

With advanced technologies and systems, businesses may have been able to detect fraud, but the chances of false positives remain high. False positives cost the bank its revenue and the customers due to the delay in the investigation, not to mention raising questions about the bank’s image and reputation.

According to a case study report from ThetaRay, an AI vendor specializing in AML solutions, an anonymous European digital bank faced a similar challenge when it started experiencing issues with late detection of financial crime and excessive false positive rates. In some instances, the existing system had missed money laundering incidents, resulting in compliance issues.

The ThetaRay report claims that the issue became:

- The rules-based system in place could not detect new suspicious patterns.

- Rule thresholds were loosened to catch more fraudulent transactions, resulting in more false positives.

- When the bank tried to solve the problem with a risk-based approach of excluding the low-value transaction, the system could not cope with a large amount of data and variables.

The case report claims that these challenges further created inefficiencies in the organization, and the bank turned to ThetaRay for a solution.

The main objective of adopting this solution was to detect fraud and decrease the rate of false positives. The case report claims solution analyzed 18 month worth of data, including:

- Month and daily account activity for retail customers

- Customers’ socio-demographic information, account information, and balances

As a result, the bank witnessed enhanced efficiency. The new system could also detect fraud cases earlier than the legacy system. ThetaRay claims that the bank also achieved the following:

- 40% reduction in false positive alerts

- Detected known money laundering cases on average 70 days prior to existing controls.

In a recent interview for Emerj’s AI in Financial Services podcast, AI Leader for PwC Middle East, Scott Nowson, describes essential ingredients to eliminate the high false positives for AML.

As Scott emphasizes throughout the podcast, it is better to examine the fraud trend first and then the data so the machine can adjust.

Explaining this approach, he says:

“A lot of transaction monitoring rules are about having a threshold. But it misses the point that finances change, and we make more money over time, and similarly, we start spending more. So it becomes essential to take for the new normal and adjust to that. In the past, we had taken this post-transaction monitoring system and applied it before the transaction monitoring was done. This made us develop new rules and ways of detecting fraud and decreasing false positives.”

– AI Leader for PwC Middle East, Dr. Scott Nowson